The housing market has moved from scarcity to surplus

The narrative is changing fast: The housing market has moved from scarcity to surplus, hitting a 14-year high in national inventory. 📈🏠 But the affordability crisis is worse than ever.

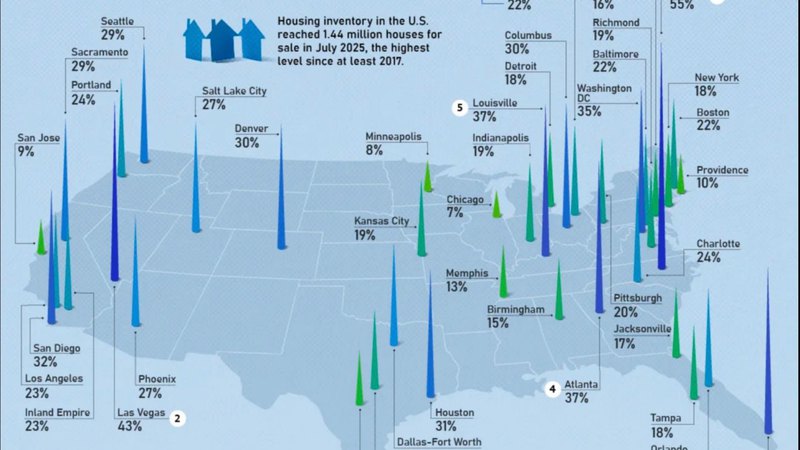

The attached graphic highlights the velocity of this shift. In just one year (July '24 to July '25), national housing stock jumped 26%. However, the story varies wildly depending on where you look.

The Inventory Surge is Massive in Sunbelt Hubs: 🌊

📍 Raleigh: +55%

📍 Las Vegas: +43%

📍 Miami: +40%

📍 Atlanta: +37%

While Other Major Markets Are Barely Moving: 🐢

📍 Chicago: +7%

📍 Minneapolis: +8%

📍 San Jose: +9%

📍 Providence: +10%

If you remember Econ 101 📚, your instinct says that when supply floods the market—especially in those +40% zones—prices must fall.

So, why is single-family housing still so unaffordable? 🤔

The issue is the stubborn gap between the cost of owning vs. renting. Even where supply is exploding, the total cost of borrowing keeps the monthly mortgage payment significantly higher than market rent. 🏘️🆚🏢

Demand is paralyzed by affordability, despite the available inventory. We are witnessing a severe dislocation between supply dynamics and pricing reality.

Something has to give. 📉

Are sellers in your area holding out for yesterday's prices, or is reality starting to set in?